What Health Care Costs Are Tax Deductible . to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). the short answer is yes, but there are some limitations. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. Can you claim medical expenses on your taxes? the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your.

from www.usatoday.com

for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. the short answer is yes, but there are some limitations. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. Can you claim medical expenses on your taxes? learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your.

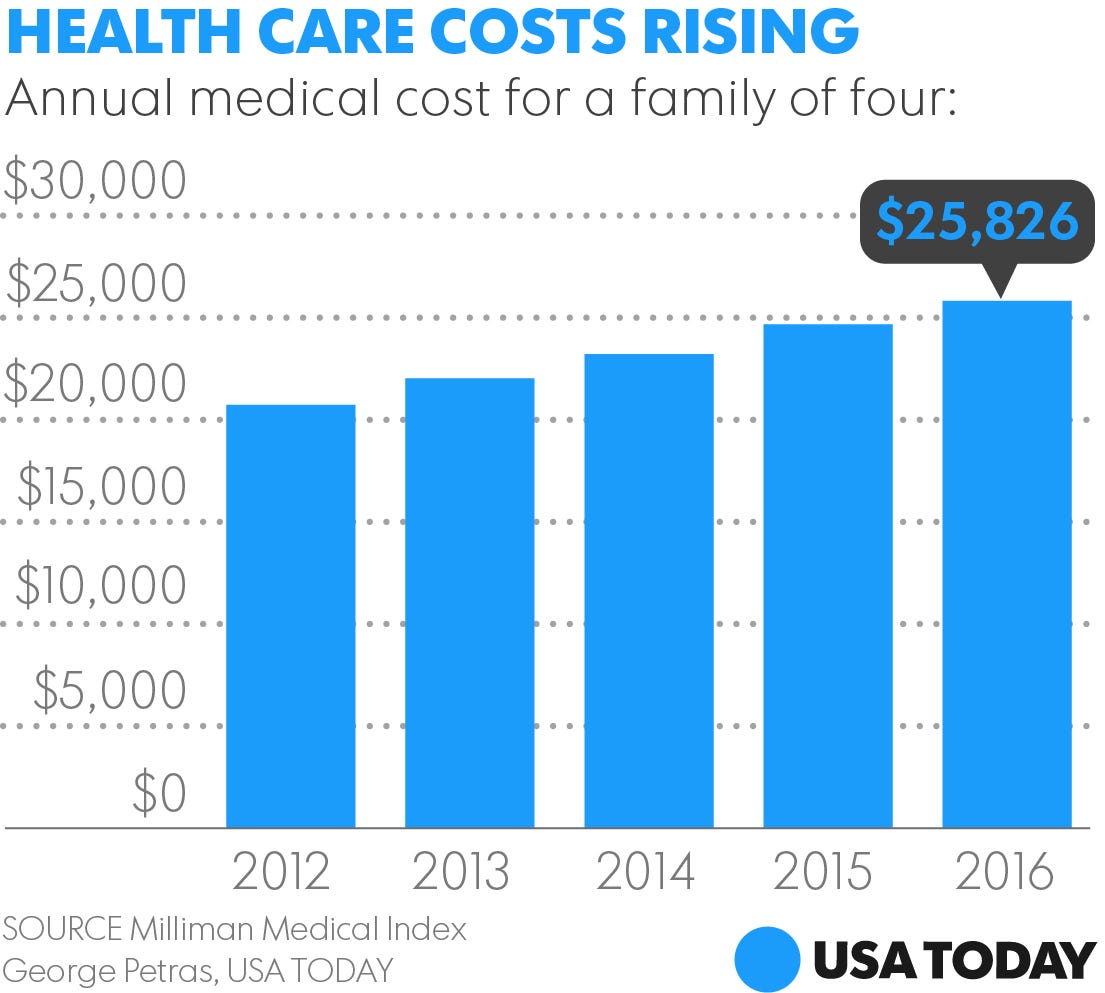

Total health care costs for typical family will top 25,000 this year

What Health Care Costs Are Tax Deductible the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. Can you claim medical expenses on your taxes? the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your. to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). the short answer is yes, but there are some limitations. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted.

From www.personalfinanceclub.com

Healthcare costs in the US have been increasing faster than overall What Health Care Costs Are Tax Deductible this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). Can you claim medical expenses on your taxes? the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. learn how to deduct medical and dental expenses you paid for yourself,. What Health Care Costs Are Tax Deductible.

From www.thepennyhoarder.com

What to Do When You Can’t Pay Your Health Insurance Deductible What Health Care Costs Are Tax Deductible Can you claim medical expenses on your taxes? the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. to benefit from medical expense deductions, your total. What Health Care Costs Are Tax Deductible.

From azexplained.com

What Health Care Costs Are Tax Deductible? AZexplained What Health Care Costs Are Tax Deductible the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. Can you claim medical expenses on your taxes? to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. learn how to deduct medical and dental expenses you paid for. What Health Care Costs Are Tax Deductible.

From www.kff.org

Health Care Costs A Primer 2012 Report KFF What Health Care Costs Are Tax Deductible for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your. the short answer is yes, but there are some limitations. Can you claim. What Health Care Costs Are Tax Deductible.

From www.pinterest.com

How to Deduct Medical Expenses Under New Tax Law Medical, Tax, Tax What Health Care Costs Are Tax Deductible for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and. What Health Care Costs Are Tax Deductible.

From blog.cdphp.com

Health Care Decoded The Daily Dose CDPHP Blog What Health Care Costs Are Tax Deductible the short answer is yes, but there are some limitations. the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your. this publication explains the itemized deduction for. What Health Care Costs Are Tax Deductible.

From exokgjdvg.blob.core.windows.net

Home Health Care Costs Tax Deductible at David Spears blog What Health Care Costs Are Tax Deductible the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. Can you claim medical expenses on your taxes? to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. learn how to deduct medical and dental expenses you paid for. What Health Care Costs Are Tax Deductible.

From www.marketresearchfuture.com

Global Healthcare Costs to Rise 10 in 2023 Survey News What Health Care Costs Are Tax Deductible the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than. What Health Care Costs Are Tax Deductible.

From www.straighttalkla.com

What’s the Deal with Copays? Straight Talk by Blue Cross and Blue What Health Care Costs Are Tax Deductible to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. the short answer is yes, but there are some limitations. learn how to deduct medical and dental expenses. What Health Care Costs Are Tax Deductible.

From www.mibluesperspectives.com

A Guide to Understanding Your Deductible What Health Care Costs Are Tax Deductible to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). the short answer is yes, but there are some limitations. the irs allows you to deduct expenses. What Health Care Costs Are Tax Deductible.

From www.agingcare.com

Can I Deduct Medical Expenses I Paid for My Parent? What Health Care Costs Are Tax Deductible the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. Can you claim medical expenses on your taxes? the short answer is yes, but there are some limitations. learn how to deduct medical and dental expenses you paid for yourself, your spouse, and your dependents if you itemize your.. What Health Care Costs Are Tax Deductible.

From www.einsurance.com

High Deductible Health Plans Are They Right For You? EINSURANCE What Health Care Costs Are Tax Deductible for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. Can you claim medical expenses on your taxes? this publication explains the itemized deduction. What Health Care Costs Are Tax Deductible.

From www.pinterest.com

Medical Expenses You Can Deduct From Your Taxes Medical, Tax time What Health Care Costs Are Tax Deductible for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. the short answer is yes, but there are some limitations. Can you claim medical expenses on your taxes? this publication explains the itemized deduction for medical and dental expenses that you claim on schedule. What Health Care Costs Are Tax Deductible.

From www.rbgcal.com

IRS Announces 2022 Limits for HSAs and HighDeductible Health Plans What Health Care Costs Are Tax Deductible this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). Can you claim medical expenses on your taxes? the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. to benefit from medical expense deductions, your total itemized deductions — deductible. What Health Care Costs Are Tax Deductible.

From azexplained.com

What Health Care Expenses Can I Deduct? AZexplained What Health Care Costs Are Tax Deductible this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,.. What Health Care Costs Are Tax Deductible.

From www.americanactionforum.org

Nearly Twothirds of U.S. Health Care Costs Financed by Taxpayers AAF What Health Care Costs Are Tax Deductible for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. learn how to deduct medical and dental expenses you paid for yourself, your spouse,. What Health Care Costs Are Tax Deductible.

From www.pinterest.com

HEALTH CARE REFORM COSTSHARING REDUCTION AND THE PREMIUM TAX CREDIT What Health Care Costs Are Tax Deductible the irs allows you to deduct expenses for many medically necessary products and services, including surgeries, prescription medications,. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted. the short answer is yes, but there are some limitations. to benefit from medical expense. What Health Care Costs Are Tax Deductible.

From www.good.is

Infographic See How Much Your Health Care Costs Are Rising GOOD What Health Care Costs Are Tax Deductible this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). to benefit from medical expense deductions, your total itemized deductions — deductible medical expenses, state and local taxes, home mortgage. the short answer is yes, but there are some limitations. the irs allows you to deduct expenses. What Health Care Costs Are Tax Deductible.